Covers you for day-to-day medical expenses. Add Everyday benefits to your policy or purchase on its own.

For the times when a day in bed won’t fix it

For the most part, we all lead happy and healthy lives. Sure, there are a few little health niggles along the way, but nothing that a hot wheat bag, a day in bed or a soak in the bath won’t fix. But every now and then, something more serious crops up and that’s when it’s good to know you and your family can get the treatment you need - without the expense and long wait times. With AA Health Insurance you can sit back and relax knowing you're covered by one of NZ's most trusted health insurance brands^.

Get 6 months Everyday Cover FREE*

Get your first 6 months Everyday Cover free when you take it out in combination with either the Private Hospital or Private Hospital & Specialist Cover before 3 December 2023.

With Everyday Cover, you can claim up to 60% of your eligible costs back, up to the annual benefit limits. That includes up to $700 worth of dental, physio, and GP consultations (after a 2-month waiting person) plus $200 worth of glasses and contact lenses at the end of a 6-month waiting period.

| AA Health Everyday Cover | Annual Benefit limits | Standard waiting period |

|---|---|---|

| Dental | $450 | 2 months |

| GP Consultations | $150 | 2 months |

| Physiotherapy | $100 | 2 months |

| Glasses and contact lenses | $200 | 6 months |

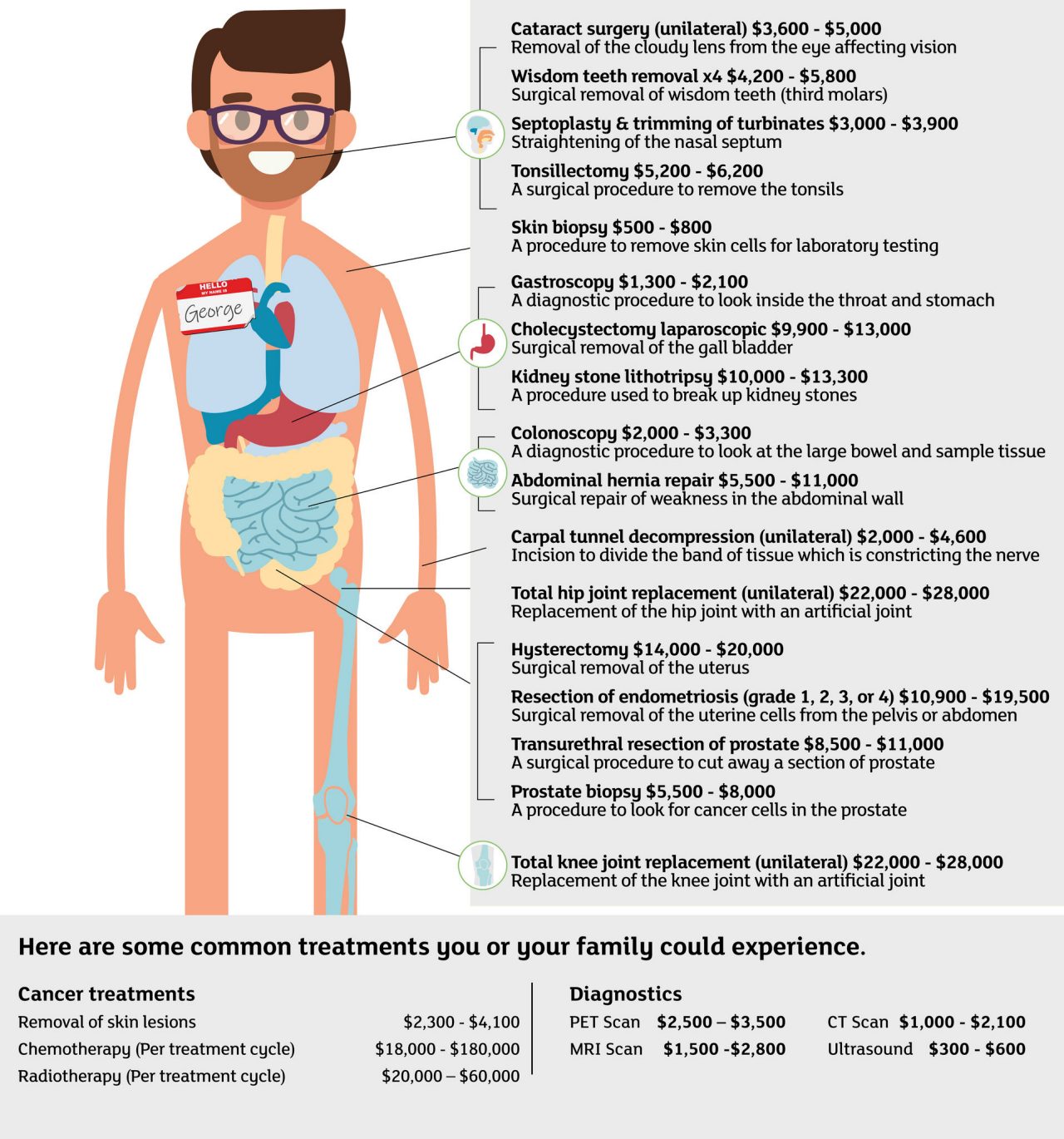

The treatment you need, when you need it.

With no health insurance in place, unexpected treatment costs could leave you in a difficult position financially. Health insurance helps pay toward these costs, and gives you control over where and who you're treated by. It's good to know how much typical procedures cost to get a better understanding whether you'd benefit from having cover in place.**

Cover Options from AA Health Insurance

Covers you for diagnostics, surgery, and treatments in a recognised private hospital, with high excess, low premium policy options.

Covers you for specialist consultations, diagnostics, surgery, and treatments in a recognised private hospital, with low excess policy options.

Optional Hospital cover add-on which covers the cost of some drugs that are Medsafe approved and prescribed under the Medsafe Guidelines but aren't funded by PHARMAC#.

The Insurer

AA Health Insurance policies are brought to you by the New Zealand Automobile Association Incorporated (AA) and are issued and underwritten by nib nz.

Financial Strength Rating

nib has been given an A (Strong) Financial Strength Rating issued by S&P Global Ratings Australia Pty Ltd.

Financial advice

Our website provides general information about products and services to help you make choices when it comes to protecting the things in life that really matter. The information doesn’t take into account your specific financial situation, needs or goals and is not intended to be financial advice.

If you'd like to receive financial advice, you can get professional advice from a registered financial adviser.

5% AA Member discount available on new AA Health Insurance policies.

5% AA Member discount available when you apply and provide your valid AA Membership number on application.

More Information

*Offer only available to new customers. Everyday Cover must be taken out in combination with Private Hospital or Private Hospital & Specialist Cover. If Private Hospital or Private Hospital and Specialist Cover is cancelled within the first 6 months, Everyday Cover is also automatically cancelled. Everyday Cover premiums will be automatically charged at the end of the 6-month free period. Customer can opt to discontinue Everyday Cover at any time before the end of the free period without incurring any charges. Offer ends 3 December 2023. Terms and conditions, exclusions and eligibility criteria apply. See full terms here.

^As voted by NZ’ers in the Readers Digest Trusted Brands Survey 2023.

AA Health is administered and underwritten by nib nz limited.

**Claims costs have been rounded in the figure above. ©2023 nib nz limited. All rights reserved. Source: nib claim statistics December 2022. This is an illustration of treatments and costs you could expect to pay if treated in a private hospital. This is not representative of conditions covered on your policy or the amount that would be paid by nib nz limited in the event of a claim.

Copyright 2023 nib nz limited. Used under licence by AA. This material is provided by nib nz limited ('nib') to the New Zealand Automobile Association Incorporated ('AA') for use by AA solely in relation to marketing the nib products the subject of the AA Health Agreement between nib and AA during the term of that agreement. nib owns all Intellectual Property and other rights relating to it.