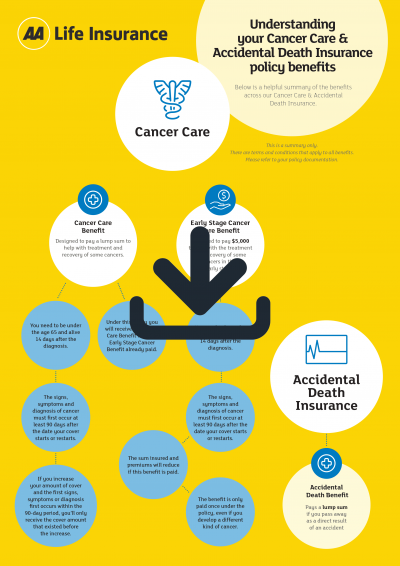

Cancer Care gives you up to $100,000 to help towards the financial stress that accompanies the diagnosis of certain types of cancer requiring treatment.

You'll be covered wherever you are in the world, and there's a $5,000 early payout if you're diagnosed with early-stage cancer.

Anyone aged 18 to 59 can apply online, at an AA Centre or over the phone with our New Zealand based team. Just bear in mind that you'll need to be a New Zealand citizen, resident or hold a valid work visa for the next 12 months.