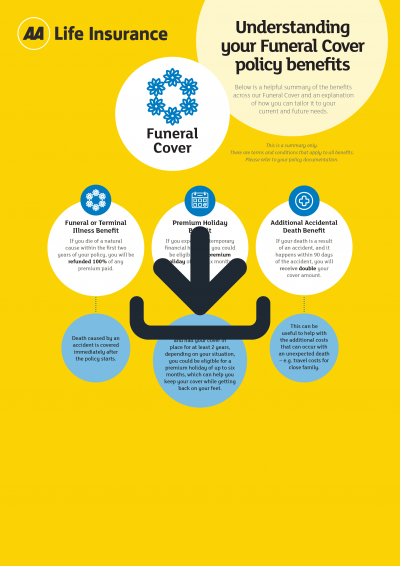

Funeral Cover is a simple insurance policy with guaranteed underwriting acceptance. You can choose up to $30,000 of cover which can be used to pay for your funeral expenses or other associated costs, putting your mind at ease.

After two years of cover, there's an early payout available for terminal illness to help you get your affairs in order. It's quick and easy to apply, where you can take out cover for yourself, someone else, or both.

Anyone aged 50 to 79 can apply online, at an AA Centre or over the phone with our New Zealand based team. Just bear in mind that you'll need to be a New Zealand citizen, resident or hold a valid work visa for the next 12 months.

Interested in knowing what a typical New Zealand funeral costs? Find out what's covered and how much Funeral Insurance you might need.