Understanding your Funeral Cover policy benefits

Learn more about your Funeral Cover policy benefits

Grand gestures of love can bring surprise and joy, but it’s the little everyday things that make us feel secure and cared for. So often, we’ll look back and realise they were actually the big things and arranging Life Cover fits squarely into this category. It may seem like a little thing now, but it’s one of the greatest expressions of love you can make, ensuring your family’s protected for whatever happens.

Show your love today and get a $100 Prezzy® Card.1 T&Cs apply. Offer ends 31 March 2026. To redeem, use promo code PREZZY26.

Plus, there's a 5% discount available for AA Members on new policies.2

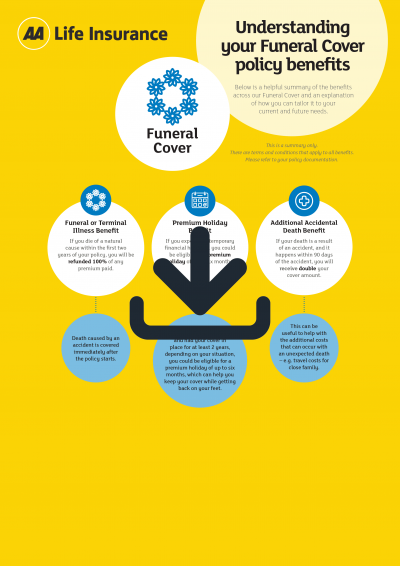

Funeral Cover is a simple insurance policy with guaranteed underwriting acceptance. You can choose up to $30,000 of cover which can be used to pay for your funeral expenses or other associated costs, putting your mind at ease.

After two years of cover, there's an early payout available for terminal illness to help you get your affairs in order. It's quick and easy to apply, where you can take out cover for yourself, someone else, or both.

Anyone aged 50 to 79 can apply online, at an AA Centre or over the phone with our New Zealand based team. Just bear in mind that you'll need to be a New Zealand citizen, resident or hold a valid work visa for the next 12 months.

Interested in knowing what a typical New Zealand funeral costs? Find out what's covered and how much Funeral Insurance you might need.

Funeral insurance can help with funeral expenses and other associated costs. We want to make sure you’re confident in knowing what you are or aren’t covered for. That means reading your policy wording to understand the benefits as well as your responsibilities, and the cover limits and exclusions of your policy.

If your death is the result of an accident (and death occurs within 90 days of the accident) we'll pay double your cover amount.

If you die of natural causes in the first 24 months of cover, we'll refund all premiums paid. If this happens after 24 months, you'll receive your full cover amount.

Depending on your situation, you could be eligible for a premium holiday of up to six months, which gives some flexibility for future financial changes in life.

*Required fields are included with an asterisk

Life Cover pays out a tax-free lump sum if you die or are diagnosed with a terminal illness, where $15,000 can be paid early to help with funeral costs.

Accidental Death Insurance covers you for death as a direct result of an accident, though not for death as a result of health issues.

Cancer Care Insurance gives you a lump sum of money to help you with financial stress that accompanies the diagnosis of certain types of cancer needing treatment.

You can take out a Funeral Cover policy for yourself or for another person, such as your parents, spouse, or friends.

You will never be singled out for a premium increase because of your age or health changes, but we do have the right to increase premiums across all Funeral Cover policies issued under the same offer made to you.

If you cancel within the 30 day no-obligation review period, we'll refund any premiums you have paid. If you cancel after this, you won't receive a refund, unless you've paid annually in advance, in which case we'll refund you for any future period already paid for.

Customers tell us that sometimes financial hardship means they have to think about cancelling their policy.

For this reason we offer a Premium Holiday Benefit to those suffering financial hardship. If you can't reasonably afford your premiums, you can apply to us, and we may be able to put them on hold for a maximum of six months so you don't have to cancel the policy while you get back on your feet. You do NOT need to pay us back. You must be under 65 years of age, and have had the policy in place for 2 years to qualify for this benefit. But please note, you can only have one Premium Holiday across the life of your Funeral Cover insurance policy.

A Joint Owner is the person who owns the policy with you. If you choose to have a Joint Owner, they will have joint ownership rights to the policy. This means they will need to consent to any changes to your policy after purchase such as change of address, wanting to increase or decrease the policy value or requesting a premium holiday.

The total maximum combined cover we will pay under all Funeral Cover policies is $30,000 for each person insured, which is in addition to any payments made under the Additional Accidental Death Benefit.

AA Life Insurance policies are brought to you by the New Zealand Automobile Association Incorporated and underwritten by Asteron Life Limited.

Asteron Life Limited has been given an "A+" (Strong) financial strength rating by Fitch Australia Pty Ltd (Fitch), an approved ratings agency.

Our website provides general information about our products and services to help you make choices when it comes to protecting the things in life that really matter. The information doesn’t take into account your specific financial situation, needs or goals and is not intended to be financial advice.

If you'd like to receive financial advice, you can get professional advice from a registered financial adviser.

1Take out a new Life Cover or Funeral Cover policy from 9 February to 31 March 2026 and get a $100 Prezzy card. You must have paid for the first two months of premiums for the new policy to qualify for the offer. The policy must be in force for two months before the card is processed. Use of the promo code PREZZY26 is required. Limit of 1 Prezzy card per policy. This offer is not available for renewing policies. For full terms and conditions please see here. You will not be eligible if your Life Cover or Funeral Cover policy, underwritten by Asteron Limited, was cancelled within three months prior to the Offer Period.

25% AA Member discount available when you provide your valid AA Membership number on application.

To access Teladoc Health services via AA Life Insurance Connected Care (“the Portal”) at no extra cost, your AA Life Insurance policy must be in-force. The New Zealand Automobile Association (Incorporated) (‘AA’) reserves the right to withdraw or modify the terms of access to AA Life Insurance Connected Care at any time. Teladoc Health Australasia Pty Limited (“Teladoc Health”) is responsible for the provision of the Portal, all health advice provided via the Portal, and Teladoc Health may suspend or terminate your use of the Portal at any time. Asteron Life Limited and AA disclaim any liability in relation to health advice provided by Teladoc Health to users of the Portal, and for any loss, claim, cost, liability, expense, or injury suffered by any person as a result of the services provided by Teladoc Health or the information or content appearing on the Portal website, except where such loss cannot be excluded by law. The Portal is not insurance (including medical insurance), and it does not replace your relationship with your treating doctor or primary healthcare practitioner. Dental and emergency conditions are excluded from the services provided via the Portal. Please review the full Portal terms and conditions, here. Mental Health Navigator, Mental Health Clinician and Nutrition and Fitness Consult are only available to people who are aged 18 years and over and are residing in New Zealand.

Over the last 11 years, AA Life Insurance has been voted Most Trusted Brand eight times and Highly Commended three times in the life insurance category of the Reader’s Digest Most Trusted Brands survey. AA Funeral Insurance has also been voted Most Trusted brand from 2021-2025 in its respective category.