Precious moments can happen at any time and in any place, whether it's watching a sunset, spending time with loved ones or simply enjoying your first coffee of the day. They matter because they remind us of what's truly important in life. That’s why helping to protect your family’s future financial security with AA Life Insurance is so important. It lets you get on with enjoying those moments knowing that, should life take an unexpected turn at any time, they’re in safe and trusted hands.

Get your cover sorted today. Sign up to AA Life Insurance and use promo code GIFT2025 to get a $100 Prezzy Card. T&Cs apply1. Offer ends 6 July.

Plus, there's a 5% discount available for AA Members on new policies2.

What is Life Cover?

Whether you have any outstanding debts, or simply want to leave something extra for a loved one, Life Cover can be there to help.

Life Cover from AA Life Insurance is a simple insurance policy that:

- Pays out a tax-free lump sum up to $1 million, if you die or are diagnosed with a terminal illness

- Allows up to $15,000 of your cover to be paid early to help with funeral costs

Anyone aged 16 to 59 can apply online, at an AA Centre or over the phone with our New Zealand based team. Just bear in mind that you'll need to be a New Zealand citizen, resident or hold a valid work visa for the next 12 months.

A quick summary

- Anyone aged 16-59 can apply

- Cover up to $1 million

- No medical examinations or reports required on application

- Immediate cover on acceptance

- Benefits include death or terminal illness, and funeral support

- Tax-free, lump-sum payout

Be confident knowing what your policy covers

We want to make sure you’re confident in knowing what you are or aren’t covered for. That means reading your policy wording to understand the benefits as well as your responsibilities, and the cover limits and exclusions of your policy.

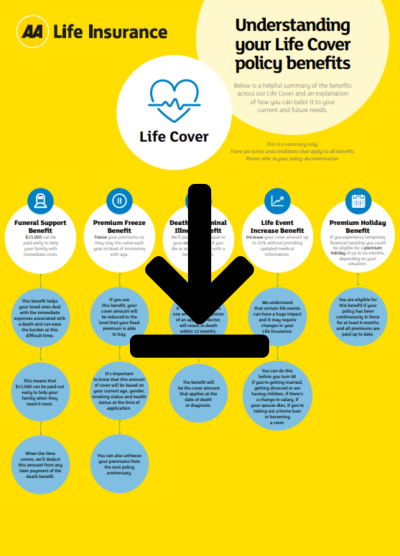

Life Cover Benefits

Death or Terminal Illness Benefit

We will pay out your cover amount benefit if you die, or pay out early if you are diagnosed with a terminal illness.

Funeral Support Benefit

We will pay a $15,000 funeral support benefit when we receive written notification of your death to help support arrangements being made in a timely way. This amount then gets deducted from the full death benefit payment, received afterwards.

Here's a guide to help you understand the Life Cover policy benefits

Things you should know

- There's a 30 day no-obligation period that gives you further peace of mind in knowing that if you change your mind in this time, we'll refund 100% of the premiums you've paid.

- Premiums can be paid fortnightly, monthly (direct debit and credit card only), quarterly, half-yearly or annually by direct debit or credit card.

- You should also consider that Life Cover isn't an investment policy, which means that if you cancel the policy, you won't receive any benefit or premium refund.

- Death by suicide is not covered for the first 13 months of cover.

- Some additional exclusions may apply depending on your situation - these exclusions are made clear to you during the application process.

- You can nominate a beneficiary which allows your cover payout to be made to someone you choose, bypassing your estate and making the money available more quickly.

Things you could consider when thinking about your cover level might include any outstanding debts like mortgage or credit cards, simple provision (maintaining lifestyle and covering kids' education), or doing something extra, like leaving a legacy.

*Required fields are included with an asterisk

More from AA Life Insurance

Funeral Cover provides up to $30,000 and can be used to pay towards your funeral expenses and other associated costs.

Accidental Death Insurance covers you for death as a direct result of an accident, though not for death as a result of health issues.

Cancer Care Insurance gives you a lump sum of money to help you with financial stress that accompanies the diagnosis of certain types of cancer needing treatment.

FAQs

The application takes between 15 - 30 minutes to complete online.

You can add a beneficiary as part of the application process, or if you'd like to add one later, you can do so by completing the Beneficiary Form on our website, or getting in touch with us. Their details are loaded against your policy so that any payouts are made to them directly. We recommend you put some provisions in place on how you'd like payments to be administered i.e. organising a will, trustee or guardian.

You may be able to, but the terms of your policy may be changed. For instance, a premium loading may apply (this means that your premiums may be more expensive). Any exclusions or premium loadings are made clear to you as part of the application process before making a decision to purchase.

If you have been smoke-free for 12 months, you may be eligible for a premium decrease. Please contact us to discuss your individual situation.

We'll ask you to answer the questions we need to know now, so that we can be transparent on price and you can tick life insurance off your list more easily. We won't need you to follow up with further medical information or complete any medical checks - once it's done, it's done.

Our insurance partner

AA Life insurance policies are brought to you by the New Zealand Automobile Association Incorporated and underwritten by Asteron Life Limited.

Financial Strength Rating

Asteron Life Limited has been given an "A" (Strong) financial strength rating by Fitch Australia Pty Ltd (Fitch), an approved ratings agency.

Financial advice

Our website provides general information about our products and services to help you make choices when it comes to protecting the things in life that really matter. The information doesn’t take into account your specific financial situation, needs or goals and is not intended to be financial advice.

If you'd like to receive financial advice, you can get professional advice from a registered financial adviser.

QUICK LINKS

5% AA Member discount available for new policies

Terms and conditions apply*

More Information

*AA Members can receive a 5% discount on new AA Life Insurance policies when a valid AA Membership number is provided on application.

1Take out a new Life Cover or Funeral Cover policy from 12 May to 6 July 2025 and get a $100 Prezzy card. You must have paid for the first two months of premiums for the new policy to qualify for the offer. The policy must be in force for two months before the card is processed. Use of the promo code GIFT2025 is required. Limit of 1 Prezzy card per policy. This offer is not available for renewing policies. For full terms and conditions please see here. You will not be eligible if your Life Cover or Funeral Cover policy, underwritten by Asteron Limited, was cancelled within three months prior to the Offer Period.

2AA Members can receive a 5% discount on new AA Life Insurance policies when a valid AA Membership number is provided on application.